Dosto, Agar aap State Bank Of India ke customer hai to aapko iske SBI Quick App ke baare me jarur janna chahiye. Yah app SBI ke taraf se ek bahut hi achhi app hai jo aapke kai problems ko solve kar sakta hai.

Is Post me ham aapko SBI Quick App ki detail jankari dene ja rahe hai. Is post ko padhne ke baad aap yah app kya hai ? Iska use aap kaise kar sakte hai ? Iske kya-kya features hai ? Isko use karne ke kya benefits hai ? in sabhi sawalo ke jawab mil jayega.

To chaliye ab ham in sabhi sawalo ke jawab detail me jaan lete hai.

Inhe Bhi Jaane :-

SBI Quick App Kya Hai ?

SBI Quick App ek App hai jisko State Bank Of India ne banwaya hai. Yah app bahut hi simple hai lekin kai problems ko solve karta hai. Is App ko SBI Missed Call Banking and SBI SMS Banking ke substitute me banaya gaya hai. Lekin isme aur bhi kai facility diya gaya hai jo hamare bahut kaam aata hai.

Isse aap wo sabhi janakri le sakte hai jo aap SBI Missed Call Banking and SBI SMS Banking se le sakte hai. Jaise –

- Balance Enquiry

- Mini Statement

- Blocking of ATM Card

- Car And Home Loan Enquiry

- 6 Month e-statement Request

- ATM Card Switch On/Off Karna

- Green PIN Generation etc

SBI Quick App Ke Benefits

Upar aapne padha ki yah app SBI Missed Call Banking and SBI SMS Banking ka substitute hai. Ab aap soch rahe honge ki tab fir hame is App ko rakhne ka kya benefits hai. To chaliye ab mai iske benefits ke baare me bata deta hu.

- Iska sabse bada benefit yah hai ki is app me hame registration nahi karna padta hai. Is app ko kewal aap apne mobile me install kijiye aur use karna start kijiye.

- Yah ek Offline App hai isliye isko Install karne ke baad aapko Net Connection ki koi jarurat nahi hai.

- SBI Missed Call Banking se in jankariyo ko lene ke liye hame SBI Toll Free numbers ko yaad / save karke rakhna padta hai. Lekin agar aapke paas SBI Quick App hai to kuch bhi Yaad / Save karke rakhne ki koi jarurat nahi hai. Bas is app ko kholiye aur upar bataye jankariyo ko turant le sakte hai.

- Isi tarah SBI SMS Banking se in jankariyo ko lene ke liye iske SMS Banking Keywords ke saath Numbers bhi yaad / save karke rakhna padta hai. Isme bhi agar aapke paas SBI Quick App hai to kuch bhi Yaad / Save karke rakhne ki koi jarurat nahi hai. Bas is app ko kholiye aur upar bataye jankariyo ko turant le sakte hai.

Iske aur bhi kai benifits hai jinko aap is Post ko last tak padne ke baad khud jaan jayenge.

Aapne dekha ki aapko na to kuch yaad rakhna hai aur na hi save karke rakhna hai. To ab aap samajh chuke honge ki isse hamara kaam kitna aasaan ho jayega.

SBI Quick App Ko Use Kaise Kare ?

Iske liye aap sabse pahle Google Play Store me jaye aur waha search kare “SBI Quick” Iske baad aapke saamne yah app aa jayega. Yaha se aap is App ko Install kar lijiye.

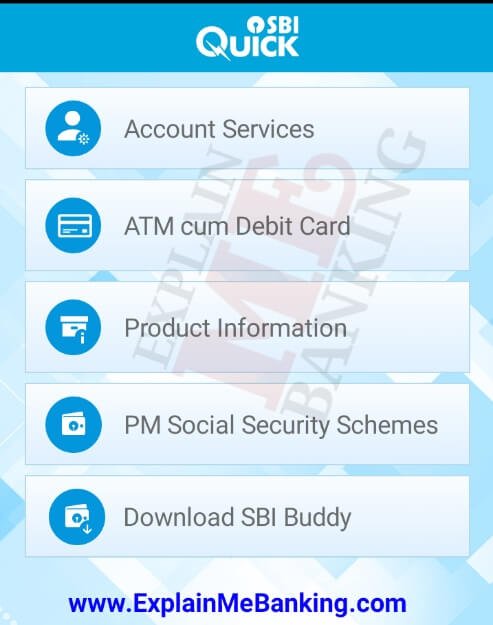

Iske baad is App ko aap Open kijiye. Ise open karte hi aapko 5 Options milenge.

- Account Services

- ATM Cum Debit Card

- Product Information

- PM Social Security Schemes

- Download SBI Buddy

Ab ham in pancho options ke baare me 1-1 karke jaan lete hai.

Important Note :- Is App ka use karte time aap pana text message ke liye us SIM Card ko select kar le jo aapke SBI Account me registered hai.

1. Account Services

Iske liye is App ke pahle option “Account Services” par click kare. Isko click karte hi aapke saamne iske sabhi options khul jayenge. Ab mai aapko iske sabhi options ke baare me ek-ek karke bata deta hu.

Registration

Is option se aap agar SBI Missed Call Banking and SBI SMS Banking ke liye apna mobile number register nahi karwaya hai to yaha se turant direct register kar sakte hai.

- Iske liye iske saamne “Message Icon” par click kare.

- Ab aapko apna account number enter karne ko bola jayega. Yaha aap pana SBI ka Account number enter karke “Continue” par click kare.

- Aapka Mobile Number registration ke liye request ho jayega.

Jab aapka Mobile number Register ho jayega to ek confirmation message bhi aapko mil jayega.

Balance Enquiry

Is Option se aap pane SBI Account ka Balance Enquiry / Check kar sakte hai.

- Iske liye aapko yaha 2 option mil jayega Message and Call. Aap jisse bhi balance enquiry karna chahte hai us icon par click kare. (Upar image me dekhe)

- Icon par click karte hi uske anushar action liya jayega aur aapka Account balance message ke dwara aapko bhej diya jayega.

Mini Statement

Is Option se aap pane SBI Mini Statement Enquiry / Check kar sakte hai.

- Iske liye bhi aapko 2 option mil jayega Message and Call. Aap jis tarah se chahe apne SBI Account ka Mini Statement mangwa sakte hai. (Upar image me dekhe)

- In Icons me click karte hi uske anusaar action liya jayega aur aapka mini statement message ke dwara aapko bhej diya jayega.

SBI 6 Month e-Statement

Is option se aap apne SBI Account ke 6 month ke andar aapka jitna bhi len den / transactions hua hai uska detail statement bheja jayega.

- Iske liye isme bane “Message Icon” par click kare. (Upar ke image me dekhe)

- Iske baad aapko aapka Account Number and koi bhi 4 Digit Number enter karne ke liye bola jayega. (Yahi 4 Digit Number aapka us SBI e-Statement ka password hoga)

- Ye dono option fill up karne ke baad “Continue” par click kare.

Iske baad aapka request le liye jayega aur aapke SBI me Registered E-Mail id me e- Statement bhej diya jayega. Aap upar enter kiye 4 digit number ke sahayta se usko kholkar dekh sakte hai.

Edu Loan Ind e-Cert

Home Loan Int e-Cert

Ye dono option jo SBI Education Loan and SBI Home Loan liye hua hai unke liye hai. Iske dwara wo apane loan ke bare me e-Statement ko mangwa sakte hai.

De-Register

Agar aap kabhi apne SBI Missed Call banking and SBI SMS Banking ko de-register yani band karna chahte hai tab yah option kaam me aayega. Apna Mobile Number De- Register karne ke liye iske Message Icon par click kare. (Upar ke image me dekhe)

Is icon par click karte hi aapka De-Registration ke liye Request ho jayega. Jab aapka De-Registration complete ho jayega to iska confirmation message bhi aapko milega.

Yaha par iska pahla option “Account services” ke sabhi options khatm hote hai. Ab ham iske dusre option ki aur badhte hai.

Inhe Bhi Jaane :-

2. ATM Cum Debit Card

Is option me aapko SBI ATM Card / Debit Card se related options milenge. Is option se aapko bahut hi achhi facility SBI ne provide kiya hai. Iske services ko janne ke liye ispar click kare. Ab aapke saamne iske 3 options aa jayega.

ATM Card Blocking

Jab kabhi aapka ATM Card lost / kho jaye ya chori / stolen ho jaye tab aap is service ka use karke usko block karwa sakte hai. Block karwane se aapko us ATM Card ke galat use ka dar nahi rahega.

- Apna ATM Card ko block karwane ke liye bas aap is option par click kare.

- Iske baad aapke ATM Card number ka last 4 digit enter karne ko bola jayega. Yaha apne ATM card number ka last 4 digit enter karke “Continue” par click kare.

- Iske baad aapka request le liya jayega aur aapka ATM card block ho jayega.

Note :- Lekin yaha par aapko ek baat ka dhyan rakhna hai ki ek baar jab aap apne SBI ATM Card ko block karwa denge uske baad wah unblock nahi hoga. Iske baad aapko New ATM Card mangwana padega.

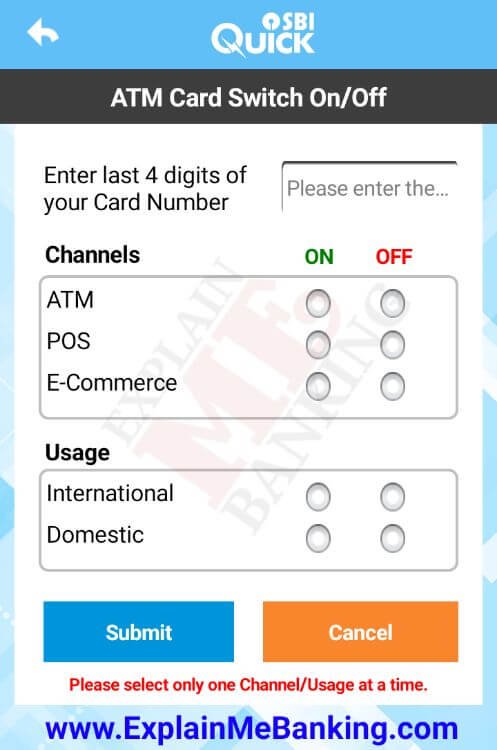

ATM Card Switch On/Off

Is option se aap apne SBI ATM Card ko Switch On / Off kar sakte hai. Yah facility bahut hi kammal ki hai. Ise aapko jarur use karna chahiye.

Isse aap ATM Card ke usses ko control kar sakte hai. Iske liye is option “ATM Card Switck On/Off” par click kare. (Upar ke image me dekhe).

- Ab iske options aapke samne khul jayega.

- Yaha aap jis bhi facility ko On ya Off karna chahte hai uspar click karke usko select kare. yaha par aap ek baar me kisi bhi ek option ko hi select kar sakte hai.

- Option select karne ke baad aap sabse upar me apne SBI ATM Card number ka last 4 digit enter kar de.

- Ab “Submit” button par click kare.

Note :- Aap isse jis bhi option ko Off kar denge waha par aapka ATM Card kaam nahi karega. Isko fir se aapko On karna padega. Isliye aap isko likhkar ya Screen Shot lekar rakh le ki kis-kis services ko aap On / Off kar rahe hai.

Generate Green PIN

Agar aapne SBI New ATM card liya hai ya apne ATM Card ka PIN bhul gaye hai to yah option aapke liye bahut hi kaam ki hai. Is Option se aap kabhi bhi apne SBI ATM Card ke liye Green PIN generate kar sakte hai aur New PIN set kar sakte hai.

- Iske liye is option “Generate Green PIN” par click kare.

- Ab aapse ATM Card Number ka Last 4 digit and Account Number ka last 4 digit enter karne ko bola jayega.

- Ye dono information enter karne ke baad “Continue” par click kare.

Iske baad aapko SBI ke taraf se sms ke dwara Green PIN bhej diya jayega. Is Green Pin ke sahayta se New Pin set kar sakte hai.

Yaha aap iske dusre option ke baare me bhi detail me jaan chuke hai. Ab ham aage badhte hai.

Iska baki ke 3 options hamare liye utne useful nahi hai. Ye 3 option kewal Product ke information ke liye hai. Chuki inse ham kisi tarah ka laabh nahi le sakte hai isliye in options ko yaha ham touch nahi kar rahe hai. Aap in options me jaakar khud hi iske baare me jankari le sakte hai.

SBI Quick App ke Charges

Agar aapko is App ko use karna hai to iske Charges ke baare me bhi aapko jaan lena chahiye.

- SBI is app ke liye khud kisi tarah ka charge nahi karta hai.

- Lekin aap jab “Message Icon” par click karke ya Services ki jankari lenge tab aapke SIM Card se ek Message jayega uska charge aapke Telecom Company and aapke plan ke anusaar hoga. Yani agar aapne Message pack liya hua hai ya Message ko FREE karwaya hua hai to usi ke hisaab se Telecom Company charge karegi.

Ab aap is SBI Quick app ke most useful Features, benefits and Uses ko jaan chuke hai. Mujhe ummid hai ki is SBI Quick app ka use aap jarur karenge aur iska benefit jarur uthayenge.

Aap is app ko use karke iske baare me apni raay hamare Comment Box me likh sakte hai. Agar aapka abhi bhi kisi tarah ka sujhaw ya sawal hai to bhi hame Comment karke jarur bataye, ham aapki madad karne ki puri kosis karenge.

Inhe Bhi Jaane :-

Kya aapne abhi tak hamare YouTube Channel “Explain Me Banking” ko Subscribe nahi kiya hai ? To abhi turant SUBSCRIBE kar lijiye aise hi kamal ke Banking se related jankariya waha bhi bhara pada hai, uska labh uthaiye.

Apne Friends, Family Member ki help karne ke liye Is Post ko unko SHARE kare. Apne Social Media Friends (Facebook, WhatsApp, Twitter…etc) ke saath bhi is Post ko SHARE karke apna Value badha sakte hai. Dhanyawad

Leave a Reply